Q3 2022 grows year-on-year, but inflation drives increase amid falling volumes

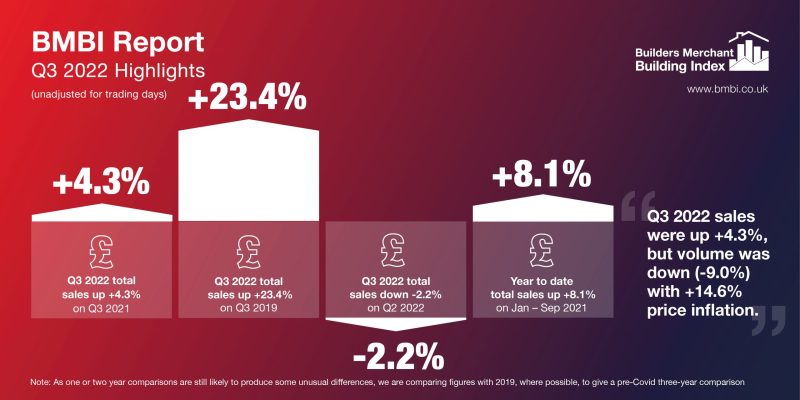

Total value sales data from Britain’s Builders’ Merchants shows Q3 2022 recorded +4.3% year-on-year growth. However, price inflation (+14.6%) continues to drive the increase in sales, as volumes fall -9.0%.

Ten of the 12 categories sold more in Q3 2022 compared to the previous year with Renewables & Water Saving growing the most (+38.4%). Workwear & Safetywear (+23.6%), Kitchens & Bathrooms (+17.2%), and Plumbing, Heating & Electrical (+14.2%) all grew faster than the Merchants overall. Landscaping (-1.3%) and Timber & Joinery Products (-11.1%) were the only categories to sell less. With one less trading day this year, like-for-like sales were +5.9% up.

Comparing Q3 2022 with Q3 2019, a more normal pre-Covid trading year, total value sales were +23.4% higher this year. Volume sales were -6.8% down while prices were up +32.4%. Despite one less trading day in the most recent period, like-for-like sales were +25.3% higher. All categories sold more, including Timber & Joinery Products (+32.3%), Renewables & Water Saving (+30.8%) and Landscaping (+28.6%) which all did better than Total Merchants.

Quarter-on-quarter, sales were down -2.2% in Q3 2022 compared to Q2 2022. Volume sales were down -5.5% and prices were up +3.5%. Despite four additional trading days in Q3, like-for-like sales were -8.3% lower. Renewables & Water Saving (+14.5%) was again the standout category, followed by Workwear & Safetywear (+8.1%) and Kitchens & Bathrooms (+6.2%). Seasonal category Landscaping (-18.3%) was weakest.

Q3 sales weren’t helped by a weak September, which was up just +3.0% year-on-year. Volume sales were down -9.6% and prices were up +13.9%. With trading days taken into account, like-for-like sales were +7.9% higher for September 2022, which benefited from an extra day. Nine of the twelve categories sold more including Renewables & Water Saving (+62.6%) and Workwear & Safetywear (+32.5%).

Total value sales in September 2022 were +28.3% higher than the same month three years ago, with no difference in trading days. Eleven of the twelve categories sold more than September 2019.

Compared to the previous month, September 2022 total merchant sales were marginally down (-0.5%). Volume sales were flat (+0.1%) compared to August, and prices fell -0.6%. Half of the 12 categories sold more, again led by Renewables & Water Saving (+28.2%).

Mike Rigby, CEO of MRA Research who produce this report, said: “The big talking point for Q3 is probably the growth spurt of the Renewables & Water Saving products category. While it is one of the smaller categories tracked by BMBI, it is now consistently at the front of the pack across a range of data comparisons. With energy cost uncertainty continuing, there is clearly a demand for more sustainable products which can help households reduce their monthly spend, whether its cutting energy or water use. Can this upward trend for Renewables & Water Saving survive consumer belt-tightening expected this winter? With government support reduced to just six months of help with homeowner bills, it might figure in the BMBI results more prominently for some time to come.”

Developed and run by MRA Research, the BMBI – a brand of the Builders Merchant Federation – is a monthly index of builders’ merchant sales, and the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK. The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for over 80% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter.

The Q3 2022 BMBI report is available to download at www.bmbi.co.uk.