Q2 value sales up +7.6% on Q1, with volume up +11.3% and prices down -3.3%

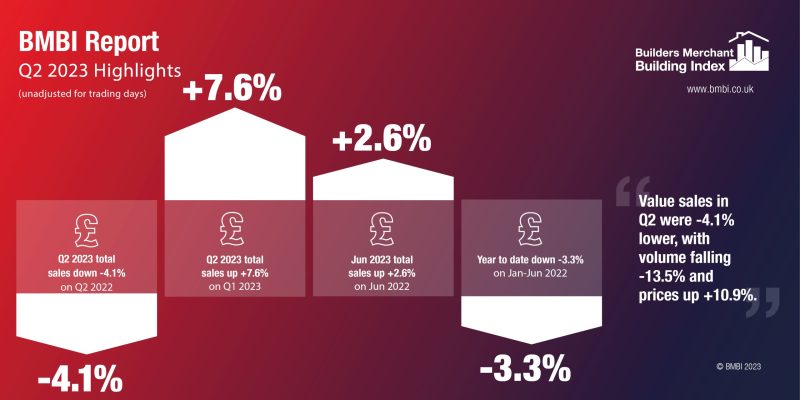

Quarter-on-quarter, total value sales from Britain’s Builders’ Merchants climbed +7.6% in Q2 2023 compared to January to March 2023. Growth came from stronger volumes (+11.3%) as prices were -3.3% lower. With four less trading days in the most recent period, like-for-like sales were +14.8% higher in April to June than Q1.

Six of the twelve categories had higher value sales, with seasonal category Landscaping (+47.3%) out in front, followed by Heavy Building Materials (+9.0%). Timber & Joinery Products (+2.1%) grew more slowly than merchants overall, while Plumbing Heating and Electrical (-12.2%) and Workwear & Safetywear (-12.7%) were the weakest categories.

Total value sales data shows Q2 2023 was down -4.1% on Q2 2022, as volumes fell -13.5% with price inflation of +10.9%.

Value sales increased in nine of the 12 categories in Q2 2023 compared to the previous year with Renewables & Water Saving (+44.4%) significantly ahead of the rest. Decorating (+12.3%), Plumbing, Heating & Electrical (+9.1%) and Ironmongery (+6.1%) also increased, and Heavy Building Materials (+0.5%) showed marginal value gain. Timber & Joinery Products (-16.3%) and Landscaping (-12.4%) both saw significant declines. There was no difference in trading days.

Total value sales for June were +2.6% ahead of the same month in 2022, helped by two extra trading days this year. Volume sales in June 2023 fell -5.4% year-on-year and prices rose +8.4%. Two of the categories, had their highest-ever monthly value sales: Decorating and Heavy Building Materials. Nine of the 12 categories sold more with Renewables & Water Saving (+37.2%), again the strongest performer. Decorating (+18.3%), Plumbing, Heating & Electrical (+18.1%), and Heavy Building Materials (+6.7%) were among the other categories with higher value sales in June. Timber & Joinery Products (-10.2%) and Services (-12.9%) were weakest. Like-for-like sales were down -6.8% year-on-year.

Compared to the previous month, June 2023 total merchant sales were +4.6% higher than May 2023. Growth was driven by a combination of higher volumes (+7.2%) and June having two more trading days. Prices were -2.5% lower in June than in May. Nine categories had higher value sales in June with Ironmongery (+7.1%) doing best, followed by Landscaping (6.9%), Kitchens & Bathrooms and Tools (both +5.9%). Like-for-like sales were down -5.0%.

Mike Rigby, CEO of MRA Research who produce this report, said: “At the half-way point in the year, June has been somewhat of a turning point for the construction industry, with monthly output finally increasing after consecutive falls. This upturn is reflected in the positive growth in merchant sales recorded by the BMBI – both in the month-on-month numbers for June, and quarter-on-quarter figures – with increases driven by volume rather than price inflation.

“Finer weather may be playing its part in getting the country building again, but inflation is also starting to come down and consumer confidence has been going up since the lows of September 2022 and during most of the first half. The latest GfK Consumer Confidence Index for July runs counter to this trend with a sharp -6 point fall, so all eyes will be on the August confidence index which is due to be published shortly.”

Developed and run by MRA Research, the BMBI – a brand of the Builders Merchant Federation – is a monthly index of builders’ merchant sales, and the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK. The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for over 80% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter.