Modest value sales growth in May but volumes continue to fall

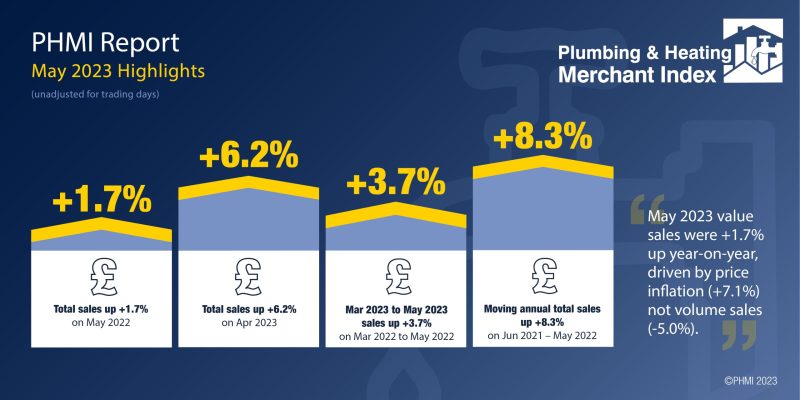

The latest figures from the Plumbing & Heating Merchant Index (PHMI) report show total value sales for May 2023 through specialist plumbing and heating merchants were +1.7% up on May last year. This growth came from price inflation of +7.1% as volumes fell -5.0%.

With one less trading day in May 2023, like-for-like value sales were +6.8% higher than May 2022.

Month-on-month, value sales in May were +6.2% ahead of April sales. Volume sales also increased +7.8% while prices fell -1.5%. With two extra trading days in May, like-for-like sales were -4.4% down.

Total value sales over the last three months, March 2023 to May 2023, were +3.7% higher than the same period a year ago. Volume sales were down -3.4% with prices increasing +7.4%. With two less trading days in the most recent three-month period, like-for-like sales were +7.1% higher.

Plumbing & Heating merchants’ value sales in the 12 months June 2022 to May 2023 were +8.3% higher than the previous twelve-month period (June 2021 to May 2022). Volumes were slightly lower (-0.9%) but prices rose sharply (+9.3%). With five less trading days in the latest period, like-for-like sales were up +10.6%.

The PHMI index for April was 97.8. With one less trading day, the like-for-like index was 101.0.

Mike Rigby, CEO of MRA Research, which produces the report says: “The effects of rising interest rates, inflation and economic uncertainty on demand continue to dent 2023 merchant sales for Plumbing and Heating specialists.

“But there is cause for optimism. Inflation is easing and, while the cost-of-living crisis continues, there is growing resilience in the market. Consumer confidence has been recovering according to GFK’s Consumer Confidence Index, with an uptick of three points recorded in both May and June. That’s still a negative -24 but 12 months ago it was -41.

“Parts of the market are thriving despite the tough conditions. Homeowners without mortgages and with savings are spending on repairs, maintenance and improvements, and builders and trades who serve them are booked well into the future.

“There are significant opportunities to increase volume sales in water and energy efficiency and the push for properties to meet more stringent Building Regulations and the Future Homes Standard in 2025.

“Following a record-breaking week for global temperatures, it’s increasingly difficult to deny the effects of climate change and there has to be an urgency to do our bit to resolve it. As an industry, we must strive to build and retrofit homes to use less energy, water and resources. This starts with well-informed merchants who ensure that products that make a difference are front and centre for customers and that environmental impact becomes as important as price, brand and quality in the purchasing decision making process.”

The Plumbing & Heating Merchant Index (PHMI) is the first to analyse point of sales data collated from specialist plumbing & heating merchants with combined annual sales of £3bn, to chart their performance month-to-month.

Based on data from GfK’s Plumbing & Heating Merchant Panel, which represents over 70% of the market by value, the report provides reliable data and a platform and voice for the industry, as well as for leading plumbing & heating brands. It is produced by MRA Research for the Builders Merchants Federation. There is no overlap or double counting between PHMI and the Builders Merchants Building Index (BMBI) sales data.

To download the latest report, or learn more about becoming an Expert, speaking on behalf of your market, visit www.phmi.co.uk.