Merchant volumes fall again but price inflation makes for a record-breaking Q2

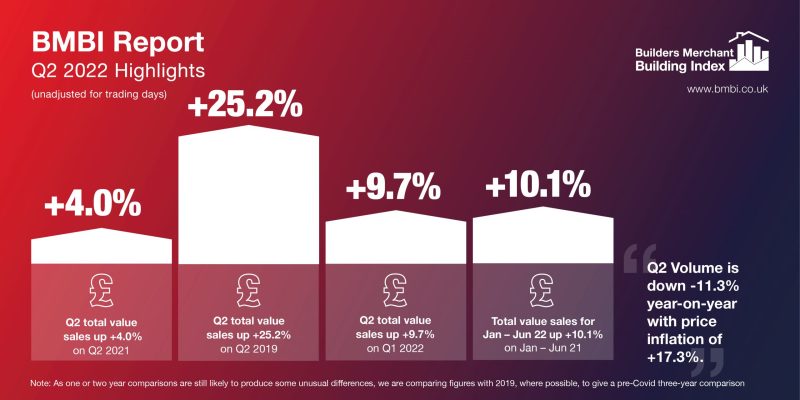

Total value sales data from Britain’s Builders’ Merchants shows Q2 2022 recorded the highest revenue since the BMBI started, despite lacklustre June sales. However, with Q2 volumes falling -11.3% compared with Q2 2021, it is +17.3% price inflation which is behind the record-breaking growth.

Quarter 2 2022 total value sales were 4.0% higher than Q2 2021, with one less trading day this year. Ten of the 12 categories sold more with Kitchens & Bathrooms (+18.5%), Heavy Building Materials (+9.2%), Decorating (+7.0%), Tools (+2.9%) and Ironmongery (+1.3%) all having their best-ever quarterly sales. Only Timber & Joinery Products (-3.0%) and Landscaping (-6.3%) sold less.

Comparing Q2 2022 with Q2 2019, a more normal pre-Covid trading year, total value sales were +25.2% higher this year, but volume sales were -2.7% down while prices were up +28.7%. Despite one less trading day, like-for-like sales were +27.3% higher. All categories sold more, including Landscaping (+38.9%), Timber & Joinery Products (+37.0%) and Renewables & Water Saving (+29.6%) which all outperformed Merchants overall. Heavy Building Materials (+22.1%) and Kitchens & Bathrooms (+20.3%) grew more slowly.

Quarter-on-quarter, sales were up 9.7% in Q2 2022 compared to Q1 2022. Volume sales were +7.9% higher and prices were up +1.6%. Like-for-like sales were +15.1% higher in Q2, despite three less trading days in the most recent quarter. Seasonal category Landscaping (+37.4%) was considerably ahead of the rest of the field with Heavy Building Materials (+12.1%) the only other category growing faster than total Merchants.

The exceptional revenues seen in Q2 came in spite of falling year-on-year sales in June (-1.0%). Volume sales for the month were -15.3% lower with prices up +17.0% compared to the same month in 2021. With two less trading days this year, like-for-like sales were up +8.9%. Nine of the twelve categories sold more, led by Kitchens & Bathrooms (+10.8%) and Renewables & Water Saving (+7.7%). Ironmongery (-1.4%), Landscaping (-8.5%) and Timber & Joinery Products (-12.2%) all sold less.

Total value sales in June 2022 were 31.0% higher than the same month three years ago, with no difference in trading days. All categories sold more than June 2019, with Landscaping (+44.5%) and Timber & Joinery Products (+40.3%) performing the best.

Compared to the previous month, June 2022 total merchant sales were -4.2% down. Volume sales were -3.7% lower than May, with prices down -0.6%. Eleven of the 12 categories sold less, with only Workwear & Safetywear (+4.2%) selling more.

Mike Rigby, CEO of MRA Research who produce this report, said: “The continuing theme for 2022 is the impact of price inflation and rising costs on the building sector which can be seen clearly in the Q2 results. A record-breaking quarter, but unlike last year, it’s price and not volume which is driving growth. With energy price reviews now every three months, and inflation expected to reach 13% around the turn of the year, this may be the case for some time to come.”

Developed and run by MRA Research, the BMBI – a brand of the Builders Merchant Federation – is a monthly index of builders’ merchant sales, and the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK. The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for over 80% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter.

The Q2 2022 BMBI report is available to download here.