Builders’ Merchant July sales edge up+0.9% year-on-year

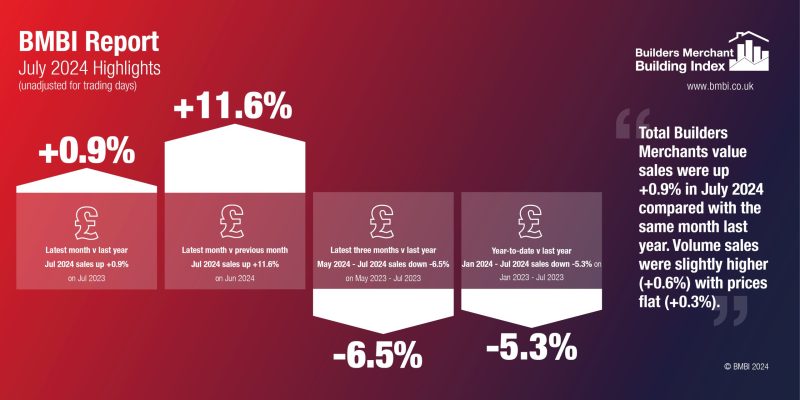

The latest Builders Merchant Building Index (BMBI) report, published in September, shows builders’ merchants’ value sales in July edged up +0.9% compared to the same month in 2023. There was a small increase in volume sales too (+0.6%) while prices remained flat (+0.3%). But with two more trading days this year, like-for-like value sales were down -7.9%.

Year-on-year, eight of the twelve categories performed better than Total Merchants, with Workwear & Safetywear (+27.7%), Tools (+9.8%) and Decorating (+8.8%) doing the best. The two largest categories – Heavy Building Materials (-0.2%) Timber & Joinery Products (-0.6%) – were virtually flat. Renewables & Water Saving (-28.4%) was the weakest category.

July total value sales were +11.6% higher than June, with volume sales increasing by +11.7% and little movement in price (-0.1%). Eight of the twelve categories outperformed Total Merchants including Workwear & Safetywear (+19.8%), Plumbing Heating & Electrical (+15.5%), Ironmongery (+15.2%) and Renewables & Water Saving (+13.7%). Kitchens & Bathrooms (+8.0%) and Landscaping (+3.3%) grew more slowly. With three extra trading days in July, like-for-like value sales were down -3.0%.

In the 12 months August 2023 to July 2024, total value sales were -5.8% lower than the same period the year before (August 2022 to July 2023). Volume sales were down -9.1% and prices up +3.7%. With four extra trading days in the most recent 12-month period, like-for-like value sales were -7.3% lower. Categories which fared better than Total Merchants included Workwear & Safetywear (+11.1%), Miscellaneous (+5.3%) and Decorating (+5.1%). The two largest categories – Heavy Building Materials (-7.4%) and Timber & Joinery Products (-9.5%) – declined by more than Total Merchants.

Total value sales from January to July were -5.3% down on the first seven months of 2023.

Mike Rigby, Managing Director of MRA Research which produces the BMBI report says: “A vast improvement in July’s weather wasn’t enough to gee up the UK construction industry, as output fell -0.4% overall with five out of nine sectors decreasing in volume according to the latest ONS data. Private commercial new work (-2.4%) and private housing repair and maintenance (-1.7%) contracted the most, reflecting the caution felt by businesses and homeowners thanks to election uncertainty and the still fragile economy.

“A new government has an opportunity to put some of those worries to bed. However, contradictory signals coming from the Prime Minister, Chancellor and Ministers have confused businesses and recent voters, by dashing expectations while still dangling pre-election promises of much better times to come.

“Promises to build 1.5 million new homes and sort out the planning system chokehold have lifted confidence in the construction industry and its supply chains. And a cut to interest rates in August was warmly welcomed by mortgage-holders. But GfK’s Consumer Confidence Index’s -7-point fall in the overall index last month, and down is an early warning to Government. All five measures in the Index are down, but the three forward looking indicators are well down. Our personal financial situation for the next 12 months, down -9; our view on the general economy for the coming year, down -12; and the major purchase index, down -10 are bad news for the economy. Together with the withdrawal of winter fuel payments and the Chancellor’s grim warnings of a painful budget, consumers have taken the Government’s economic black hole alert to heart. Given that consumer confidence underpins consumer spending, which underpins economic growth, which the Government wants, the Prime Minister’s and Chancellor’s dire warnings could be a costly own goal”.

Set up and run by MRA Research, the BMBI – a brand of the Builders Merchants Federation – is a monthly index of builders’ merchant sales, and the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK. The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for 88% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter.