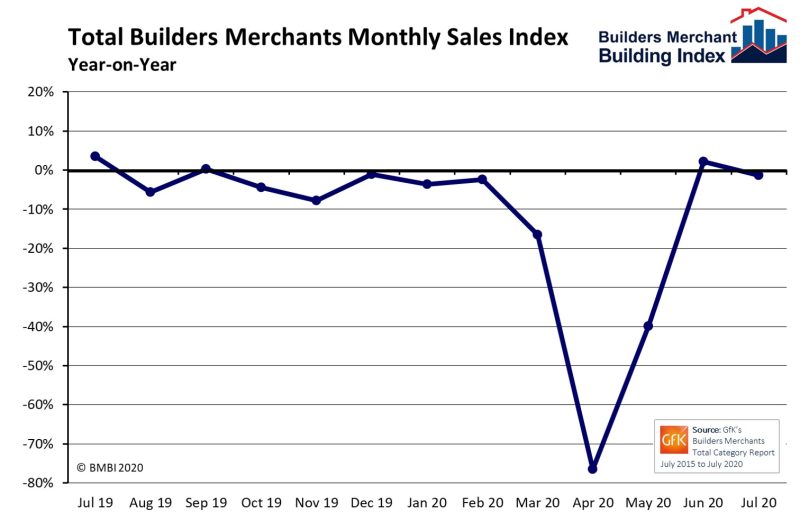

Professional Housebuilder & Property Developer Column – Builders’ Merchants sales confirm strong V-shaped recovery

Britain’s builders’ merchants sales to builders and contractors bounced back strongly in the three months May to July, with value sales surging 38.9% ahead compared with February to April, as reported in July’s Builders Merchants Building Index (BMBI) report. Landscaping was significantly ahead of all categories at +130.4% over the period. Timber & Joinery products followed with +44.3%.

Year-on-year

Compared with the same three months of 2019 total sales were down 13.4% overall, but July sales were only 1.3% below July 2019 and some categories were ahead. Landscaping (+25.4%), Workwear & Safetywear (+21.3%) and Timber & Joinery Products (+1.5%) were up on the same month last year.

Month-on-month

Total value sales was up +8.7% in July compared to June 2020, with all but one category reporting growth. Workwear & Safetywear was top (+34.1%), followed by Kitchens & Bathrooms (+27.3%). While Landscaping reported significant year-on-year growth, sales were down -6.9% in July compared to June.

Index

The monthly BMBI index for Total Builders Merchants was 131.9, with Heavy Building Materials, the largest category, at 125.6. Landscaping was ahead of all categories with an index of 208.2.

Stacey Temprell, Marketing Director British Gypsum and BMBI’s Expert for Drylining Systems comments: “Unsurprisingly the impact of COVID-19 still dominates and will do so for the foreseeable future but, as we come through this period, we are starting to see some glimmers of hope that we can emerge from the pandemic. The government has committed to £1.3bn investment to deliver new homes, improve skills, create jobs and upgrades to local infrastructure. This, alongside the prime minister’s strategy of ‘Build, Build, Build’, gives us the strong government-backed intent we need to recover from this crisis.

“There is no question that this high-profile government stimulus will support the new build housing and commercial build markets. Conversely, unemployment levels over the coming months could have a significant impact on consumer confidence and the domestic RMI market. While the stamp duty holiday grabbed the headlines, this initiative is unlikely to bring any immediate benefits to the slower property market, which also has a significant impact on RMI demand as people like to improve their new home after they’ve moved in.

“As an industry, we have a long road of recovery ahead of us, but what COVID-19 has taught us is that how we respond to the challenges ahead of us is entirely within our gift. Like all businesses we have had to implement change at record pace, but we’ve demonstrated that we can rise to this challenge. We have all modified our working practices overnight to enable business to move forward and buildings to get built. We have accelerated the adoption of digital collaboration across the construction industry almost overnight. Right now, we have an incredible opportunity to further embrace digital technologies and drive out inefficiencies in the construction supply chain. By doing so we are paving the way for a new, more resilient construction economy.

“This period has been tough, tougher than we expected but we are optimistic that this new sense of construction-community will remain. Our immediate priority is to work closely with our customers to ensure that future generations of construction professionals are better able to deal with future threats.”