BuildingTalk: Year-on-year sales growth in double digits but returning to trend

The latest figures from the Builders Merchant Building Index (BMBI), published in December, reveal that merchants’ year-on-year value sales to builders and contractors were 11.1% higher in October 2021 compared to the same month in 2020.

Double digit value growth in a more normal year would be remarkable, but this relatively modest year-on-year growth contrasts sharply with the spectacular gains seen since summer 2020, as confidence returned after the country emerged from Lockdown One.

Eight out of twelve categories sold more in October 2021 compared to the same month in 2020, despite one less trading day this year. Timber & Joinery Products continued to top the list (+28.3%), while Landscaping (+9.5%), Heavy Building Materials (+6.5%), and Kitchens & Bathrooms (+4.7%) grew more slowly. Of the four categories that sold less, Workwear & Safetywear (-7.8%) was weakest.

Like-for-like sales, which take trading day differences into account, were up 16.4% year-on-year.

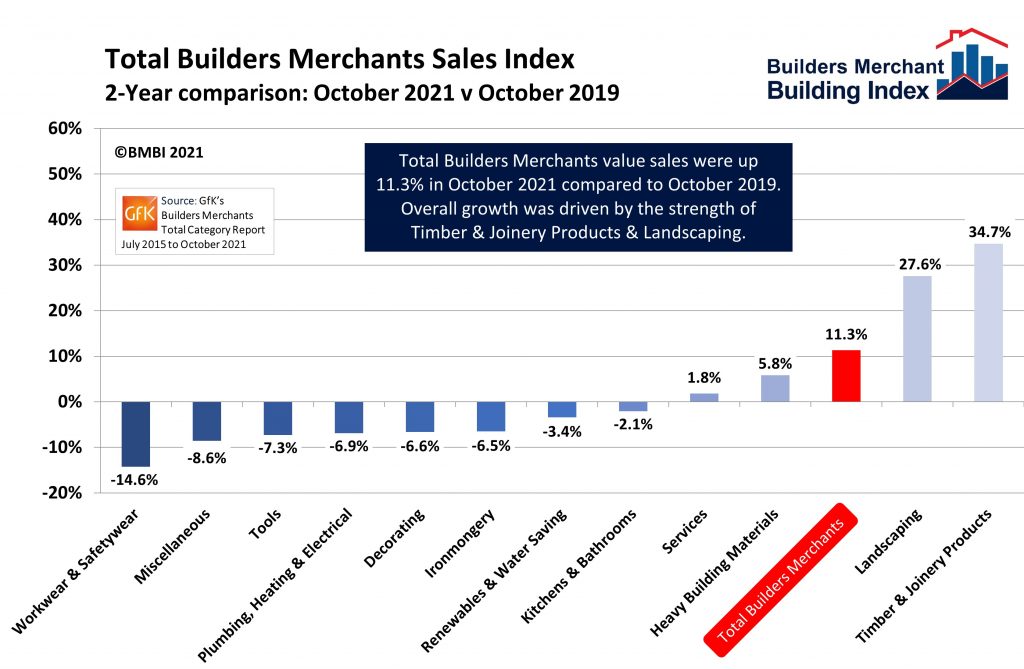

Compared to October 2019, a pre-pandemic year, total merchant value sales were up 11.3% in October 2021, with two less trading days. Four categories sold more, with overall growth driven primarily by the strength of Timber & Joinery Products (+34.7%) and Landscaping (+27.6%). Heavy Building Materials (+5.8%) and Services (+1.8%) also sold more compared to the same month two years ago. Workwear & Safetywear (-14.6%) was again the weakest category. Total like-for-like value sales were 21.9% higher.

Last three months

Total sales in the three months August to October 2021 were up 16.1% on the same period last year. Eleven of the twelve categories sold more, with Timber & Joinery Products (+38.9%) especially strong. Other categories grew more slowly, including Heavy Building Materials (+10.4%), Landscaping and Kitchens & Bathrooms (+9.2%) and Plumbing, Heating & Electrical (+9.1%).

Compared to the same three months in 2019, sales were 17.9% higher, with one less trading day in August to October 2021. Total like-for-like sales were 19.7% higher.

Month-on-month

Total merchant sales were down 5.1% in October 2021 compared to September 2021, with one less trading day in October. Only Workwear & Safetywear (+8.4%), Plumbing, Heating & Electrical (+3.4%) and Renewables & Water Saving (+0.9%) sold more. Seasonal category Landscaping (-13.6%) was the weakest month-on-month.

Year-to-date

Total value sales January to October 2021 were up 33.1% compared with the same 10 months in 2020, with three less trading days this year. All categories sold more. Year-to-date sales were also up 14.7% on January to October 2019, again with three less trading days this year.

Index

October’s BMBI index was 140.4, helped by another robust performance from Timber & Joinery Products (181.0). All bar one category recorded indices above 100, including Landscaping (148.5), Plumbing, Heating & Electrical (131.0) and Heavy Building Materials (130.8). Only Renewables (71.5) fell below 100.

Krystal Williams, Managing Director at Pavestone and BMBI’s Expert for Natural Stone & Porcelain Paving, comments: “The market has started to slow down as we move past the unprecedented peaks in demand experienced in 2020 and early 2021.

“A combination of being able to travel and homeowners having other things to spend their savings on has pushed RMI down the priorities’ list, and sales are back to a manageable level.

“The sudden drop in demand has left many suppliers and merchants with surplus stock after months of buy, buy, buy. While the temptation is to shift excess stock, it’s worth maintaining healthy levels on key lines as we expect strong demand in the Spring.

“Things have certainly not been ‘fixed’”

“Whilst Shipping prices have finally plateaued, and UK port congestion seems to be getting better, things have certainly not been ‘fixed’. We’re only seeing an improvement as demand has dropped. Should demand rise heavily again, we can expect much of the same with haulage shortages, port congestion and many shipping lines refusing to stop at some UK ports.

“Porcelain sales have been another positive. Sales have grown despite sandstone and other alternatives being available. Merchants now have much more confidence to sell porcelain and we hope this will continue in the future.

“Looking ahead, there is a new colour trend on the horizon for Q4 and 2022: greige (grey beige). It’s a soft grey, and a warmer contemporary product. We’re seeing this hit European markets quite heavily and we expect it to have a big impact here.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. For the latest reports, Expert comments and Round Table videos, visit www.bmbi.co.uk

This column was published on www.buildingtalk.com on 22nd December 2021.