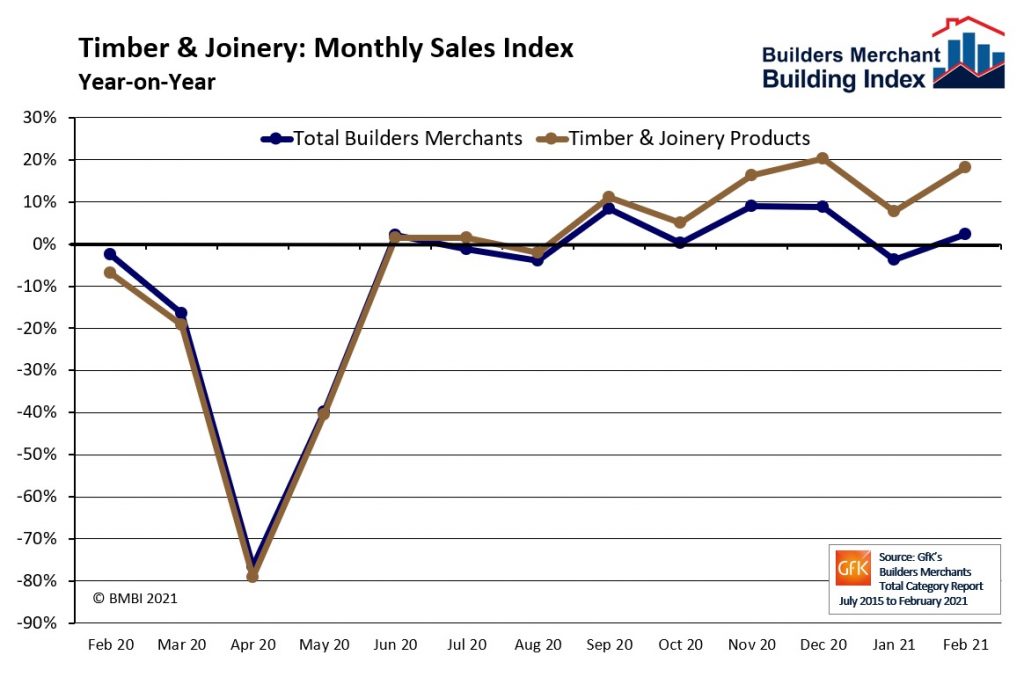

BuildingTalk.com blog: February sales growth driven by Timber & Joinery Products

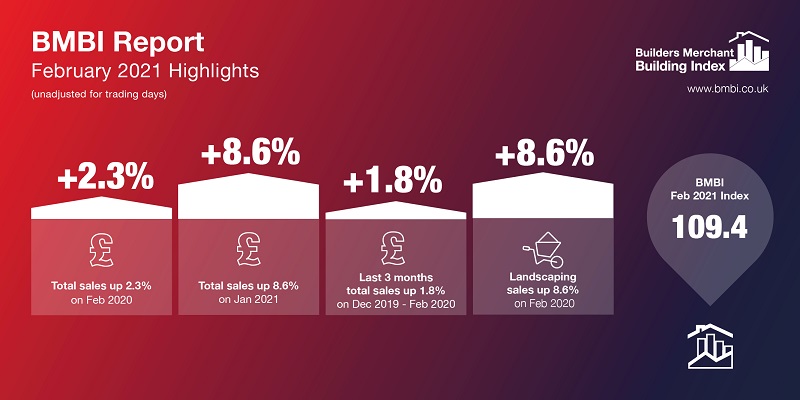

According to the latest Builders Merchants Building Index (BMBI) report, published in April, value sales to builders, roofers and contractors in February were 2.3% higher than in February 2020, on an equal number of trading days. Growth was driven by Timber & Joinery, which saw an 18.2% increase year-on-year.

Year-on-year

Only three of the twelve categories sold more in February 2021 compared to February 2020. Other categories with higher sales were Landscaping (+8.6%) and Tools (+2.0%).

Categories with lower sales over the period included Heavy Building Materials and indoor trades, which continue to be impacted by the latest lockdown. Sales were significantly lower than last year for Kitchens & Bathrooms (-8.6%), Decorating (-8.4%) and Plumbing Heating & Electrical (-3.6%).

Last three months

Total sales in the last three months (December 2020 to February 2021) were 1.8% higher than in December 2019 to February 2020, on an equal number of trading days. Timber & Joinery Products (+14.8%) and Landscaping (+11.0%) were the top performing categories.

Month-on-month

Total Merchants’ February sales were 8.6% higher than in January, with no difference in trading days. Landscaping did best (+24.1%), followed by Kitchens & Bathrooms, Decorating and Tools. Workwear & Safetywear (-9.0%) was weakest.

Rolling 12 months

Merchants’ sales over the 12 months to February 2021 were 10.4% lower than in the preceding 12 months. Sales in most categories remain lower than before the pandemic, with Landscaping (+6.0%) the only category to show recovery.

Index

February’s BMBI index was 109.4, with Timber & Joinery Products the strongest at 128.8.

Andy Scothern, Managing Director for eCommonSense and BMBI’s Expert for Website & Product Data Management Solutions, comments:

“Finally, there are signs with the vaccine roll-out that we are coming out the other side. This will create much-needed hope for many builders’ merchants. So what should merchants be doing to emerge in the strongest shape possible and take advantage of the opportunities to make sure that their business thrives during 2021?

“Research and case studies examining recent recessions and their impacts on companies help provide the answers. The most interesting findings focus on four areas of difference between success and failure: debt, decision making, workforce management, and digital transformation.

“The main message running through all of them is that recessions are a high-pressure exercise in change management and those that emerge the strongest need to be flexible and ready to adjust.

“During the recessions of 1980, 1990, and 2000, a Harvard Business Review article showed how 9% of companies didn’t just recover in the following three years, they flourished, outperforming competitors by at least 10% in sales and profit growth. The reason was down to one factor: preparation. Firms that made contingency plans or thought through the possible scenarios, fared best.

“History shows that downturns encourage the adoption of new technologies, but many merchants are asking if they should invest in new digital technologies when money is tight?

“One reason is that digital makes companies more agile and therefore better able to handle uncertainty. For merchants, digital creates more flexibility around product and volume changes and, importantly, it opens new markets.”

This article was first published at BuildingTalk.com